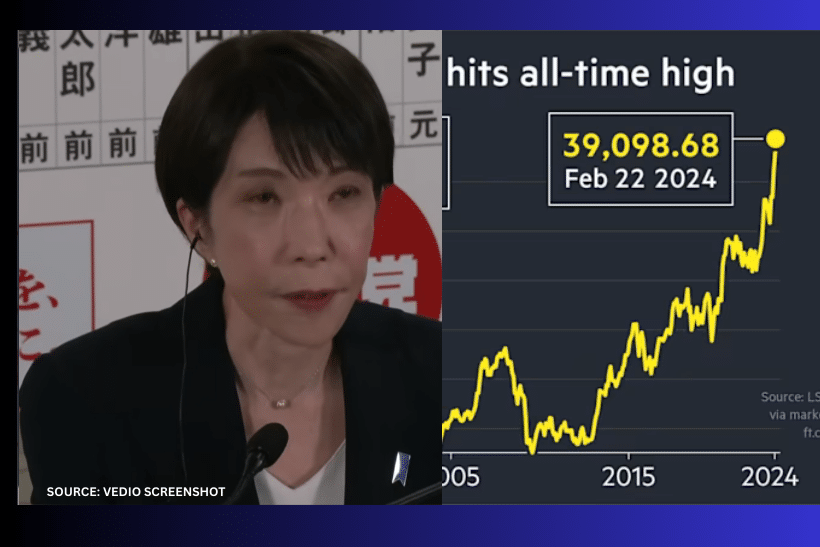

Japan’s Nikkei 225 surged to a new all-time high, rising about 6 percent, after Prime Minister Sanae Takaichi’s election victory boosted investor confidence and fueled a rally in Tokyo stocks.

The benchmark index jumped as markets reacted to expectations of policy continuity, pro-business reforms and stronger support for Japan’s export-heavy economy.

Shares of major exporters and technology firms led the gains, benefiting from a weaker yen and optimism that the new government will maintain accommodative economic policies.

Investors said Takaichi’s victory reduced political uncertainty and signaled stability for markets at a time of global volatility. Analysts noted that expectations of continued fiscal support and coordination with the Bank of Japan helped drive the sharp one-day rally, alongside renewed foreign inflows into Japanese equities.

The rally extended gains seen earlier this year, with Japanese stocks outperforming several global peers as corporate governance reforms, share buybacks and earnings growth continue to attract international investors.

Market participants said sentiment was further lifted by hopes that the new administration would press ahead with measures to boost productivity, wages and investment.

The Nikkei’s record close underscores growing optimism about Japan’s economic outlook, even as traders continue to monitor global interest rates, currency moves and geopolitical risks that could influence markets in the weeks ahead.