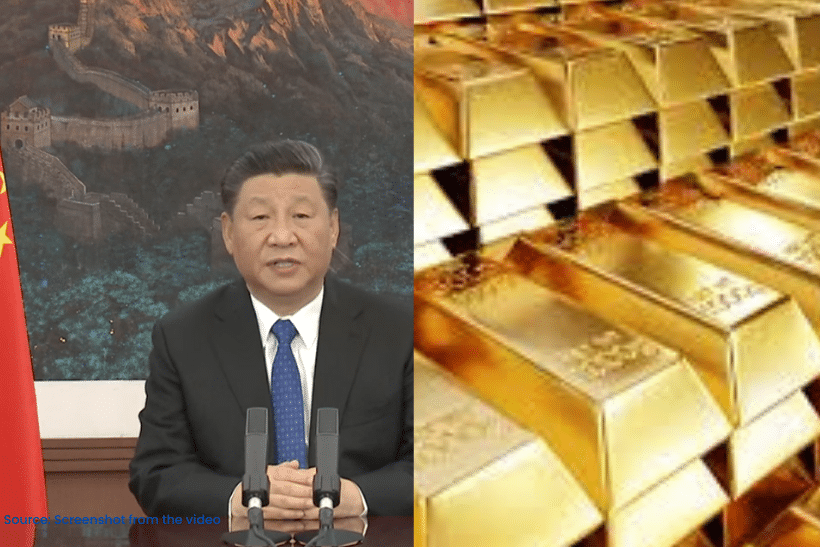

China’s official gold reserves have surpassed 74 million ounces, with the total value of the holdings estimated at more than $7 billion, according to the latest data from the People’s Bank of China and global market pricing.

The increase reflects Beijing’s ongoing effort to diversify its foreign reserves and reduce dependence on any single currency, officials and analysts said. Gold has long been seen by policy makers as a strategic asset that provides stability during periods of financial volatility and geopolitical tension.

China is among the world’s largest official holders of gold, ranking behind only a few major economies such as the United States. The nation steadily increased its gold purchases over the past decade, often adding to reserves at times of favorable prices or market uncertainty.

Economists say central banks around the world have been accumulating more gold as a hedge against inflation and as a store of value that cannot be frozen or devalued in the way some financial assets can. Gold’s role as a traditional safe-haven asset has attracted sustained interest from China’s monetary authorities as they seek to bolster confidence in the country’s reserve portfolio.

China’s gold reserves are updated periodically by the central bank and are valued at market prices, meaning the total dollar value can fluctuate with changes in the gold price. At current prices, the reserves exceed 74 million ounces and are worth more than $7 billion, highlighting the continued prominence of gold in national reserve strategies.

Officials have not detailed their future plans for further gold purchases, but analysts said the trend of diversification is likely to continue as China navigates shifts in the global economic landscape.

Verified, Fast hand And Authentic News be connected to DNNPOST